Is Life Insurance An Allowable Business Expense

Directors and business owners can run their life insurance through their company as a business expense. A pay out from a relevant life insurance policy will be paid out to the insureds loved ones upon their passing.

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Tax Preparation Income Tax Preparation Income Tax

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Tax Preparation Income Tax Preparation Income Tax

You cant claim expenses for buying or building your business premises.

Is life insurance an allowable business expense. 112017 In most cases you cannot deduct your life insurance premiums. 1302019 Deducting your life insurance premiums as a business expense makes the benefits on the policy become taxable. Business Life Insurance quote of 231 per week is based on a key man policy of a 31 year old non-smoking male with 200k of cover over 15 years with Legal.

Accountancy legal and other professional fees can count as allowable business expenses. Any life insurance policy which has an element of investment is not allowed in any case. Our Relevant Life Plan is a cost-efficient way of offering life cover to you or your employees.

However take out an insurance policy to pay off a loan taken privately that was used to inject capital into the business and it is not allowable as the beneficiary is the persons. Hiring of accountants solicitors surveyors and architects for business reasons. Take a common example of life insurance taken out for a business loan which pays only the loan company on death of the insured.

2182015 A life insurance policy for example would not be tax deductible as it doesnt serve a purely business purpose. You can claim costs for. How does it work.

The cost of a regular company event is covered as long as the total doesnt exceed 150 per person good news for business owners who enjoy seeing their staff bust out their most impressive dance moves at the. Also premiums are not classed as a benefit-in-kind for employees so no income tax or national insurance is payable on the premiums. If you do this with a large group policy beyond the 50000 of coverage available for S Corps and LLCs this means that all of your employees will get saddled with a tax on their benefits.

The alternative would be keyman insurance. That would be a gegitimate expense. You can protect your business or your family and claim back tax on your life insurance premiums.

Check that the life assurance you have in place is suitable and meets your familys needs. Like most insurance. The only way that could be considered a business expense is if it was part of his remuneration assuming he is operating through a company and he was then taxed on it as income.

This will result in a massive saving compared to. If you run your business from home you can include part of your home utility bills but you need to work out the proportion of your home thats used for business and what proportion of the month its being used for business purposes. With Corporation tax relief available no additional income tax or National Insurance to pay its good business for both you and your employees.

862008 The general principle on life insurance is that if you claim the premiums as an expense any proceeds are taxable - so the policy pays out and the Revenue take 40 which defeats the object somewhat. However if you use your life insurance policy as collateral for a loan related to your business including a fishing business you may be able to deduct a limited part of the premiums you paid. So there are still benefits to obtaining a key policy for business owners and sole traders.

3282017 Financial expenses such as the interest on your business loans overdraft credit card and bank charges are all allowable including the cost of hiring an accountant. 9232020 The company can claim the cost against its Corporation Tax bill 19 as this is an allowable business expense. Typically a relevant life insurance policy is classed as an allowable business expense and is tax-deductible.

Its tax efficient and typically cases premiums can be treated as an allowable business expense by HMRC. The employee often a director does not need to pay for cover out of hisher post-tax income. 732011 Straight life insurance would presumably be for the benefit of his family in the event of something happening to him out there.

Marked as generally allowable in this pamphlet must also meet the five criteria at FAR 31201-2 including allocability and reasonableness to be allowable as a claimed cost on US. Costs of the premiums are met by the business and are usually an allowable business expense. On the other hand a policy which covers against injuries to employees is clearly a valid business expense.

192018 Whilst the premiums are not an allowable business expense the payout is usually tax-free.

Can I Claim Life Insurance As A Business Expense Tax Deductibility

Can I Claim Life Insurance As A Business Expense Tax Deductibility

Start Today Repeat Tomorrow The Process Is Complicated There Are Many Steps Along The Way The Key Business Goals Quotes Entrepreneur Motivation Motivation

Start Today Repeat Tomorrow The Process Is Complicated There Are Many Steps Along The Way The Key Business Goals Quotes Entrepreneur Motivation Motivation

Publication 502 2013 Medical And Dental Expenses Medical Health Savings Account Internal Revenue Service

Publication 502 2013 Medical And Dental Expenses Medical Health Savings Account Internal Revenue Service

Is Life Insurance An Allowable Business Expense 2021 Guide

Is Life Insurance An Allowable Business Expense 2021 Guide

How Do I Renew My Uk Passport Online Passport Online British Passport Passport

How Do I Renew My Uk Passport Online Passport Online British Passport Passport

Save Money With This Free To Download Allowable Tax Expenses Swipefile Business Tax Business Expense Small Business Finance

Save Money With This Free To Download Allowable Tax Expenses Swipefile Business Tax Business Expense Small Business Finance

Taxes For Freelancers For All The Visual Learners Out There This Board Is For You We Ve Condensed Complicated Tax Topics Online Taxes Diy Taxes Tax Guide

Taxes For Freelancers For All The Visual Learners Out There This Board Is For You We Ve Condensed Complicated Tax Topics Online Taxes Diy Taxes Tax Guide

Are Insurance Payments Tax Deductible Infographics Article

Are Insurance Payments Tax Deductible Infographics Article

Cra Allowable Home Business Expenses During Home Business Tax Forms Canada Make Money Drop Shipping Am Business Ideas Entrepreneur Business Money Business Tax

Cra Allowable Home Business Expenses During Home Business Tax Forms Canada Make Money Drop Shipping Am Business Ideas Entrepreneur Business Money Business Tax

What Are Disallowable Expenses Go Self Employed Self Small Business Bookkeeping Small Business Plan

What Are Disallowable Expenses Go Self Employed Self Small Business Bookkeeping Small Business Plan

Relevant Life Insurance Policies Are You Missing Out On Thousands

Relevant Life Insurance Policies Are You Missing Out On Thousands

Maternity And Coverage Defined Life Insurance Policy Group Health Insurance Group Insurance

Maternity And Coverage Defined Life Insurance Policy Group Health Insurance Group Insurance

Is Life Insurance An Allowable Business Expense 2021 Guide

Is Life Insurance An Allowable Business Expense 2021 Guide

How Save Money On Your Self Employed Taxes Bookkeeping Business Small Business Bookkeeping Business Tax

How Save Money On Your Self Employed Taxes Bookkeeping Business Small Business Bookkeeping Business Tax

Free Downloads Creativechamps Visual Artist Educational Tools Art Base

Free Downloads Creativechamps Visual Artist Educational Tools Art Base

Year End Tax Plan Template Sample Financial Savvy How To Plan Money Management

Year End Tax Plan Template Sample Financial Savvy How To Plan Money Management

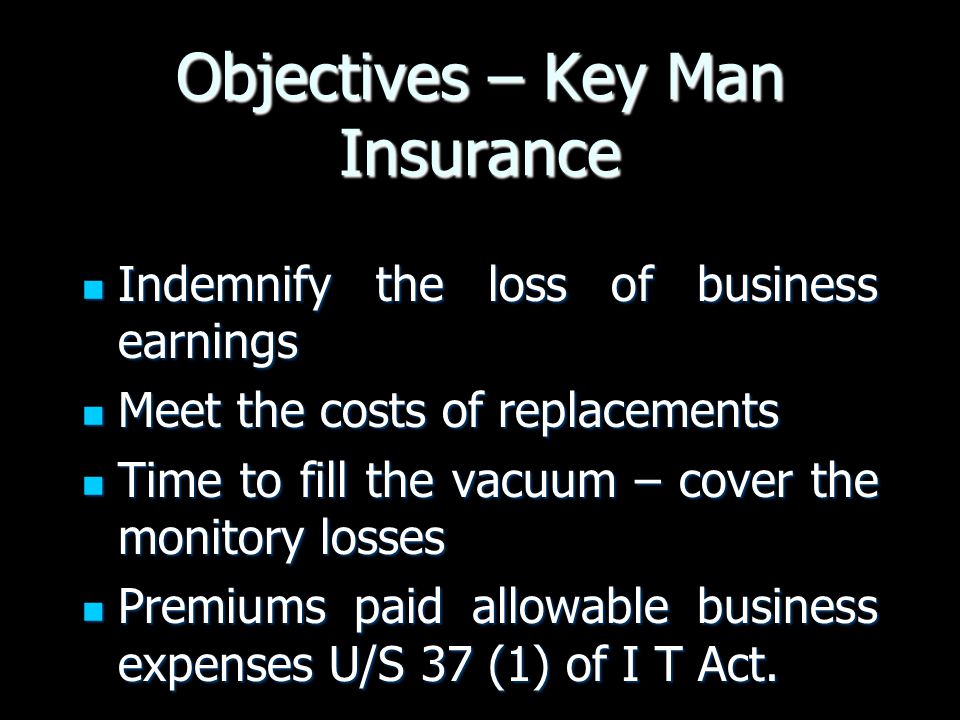

Market Conduct Examination A Case Study On Key Man Insurance Policies Conference On Regulatory Issues For Sr Officers Of Insurance Regulatory Agencies Ppt Download

Market Conduct Examination A Case Study On Key Man Insurance Policies Conference On Regulatory Issues For Sr Officers Of Insurance Regulatory Agencies Ppt Download

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge Tax Forms Income Tax Income

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge Tax Forms Income Tax Income

Post a Comment for "Is Life Insurance An Allowable Business Expense"