Insurance Service Expense Ifrs 17

Financial guarantee contracts if the entity has asserted it regards such contracts as insurance contracts otherwise such contracts are within the scope of IFRS 9. Technical summary of IFRS 17 Objective IFRS 17 Insurance contracts establishes the principles for the recognition measurement presentation and disclosure of Insurance contracts within the scope of the Standard.

IFRS 17 Income Statement 9 9 PL 20X1 20X0 Insurance revenue 9856 8567 Insurance service expenses 9069 8489 Incurred claims and insurance contract expenses 7362 7012 Insurance contract acquisition costs 1259 1150 Gain or loss from reinsurance 448 327 Insurance service result 787 78 Investment income 9902 9030.

Insurance service expense ifrs 17. The objective of IFRS 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. IFRS 17 may apply to. IFRS 17 Insurance Contracts.

The staff recommended the Board revise its tentative decision to establish in IFRS 17 that an investment-return service exists only when an insurance contract includes an investment component to instead specify that an investment-return service exists if and only if. 4 IFRS 17 Insurance Contracts. Insurance revenue and service expenses.

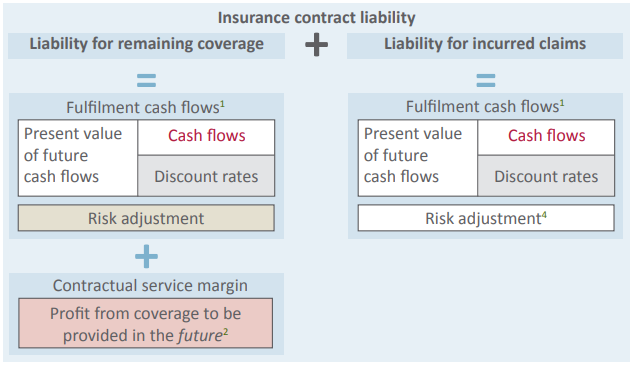

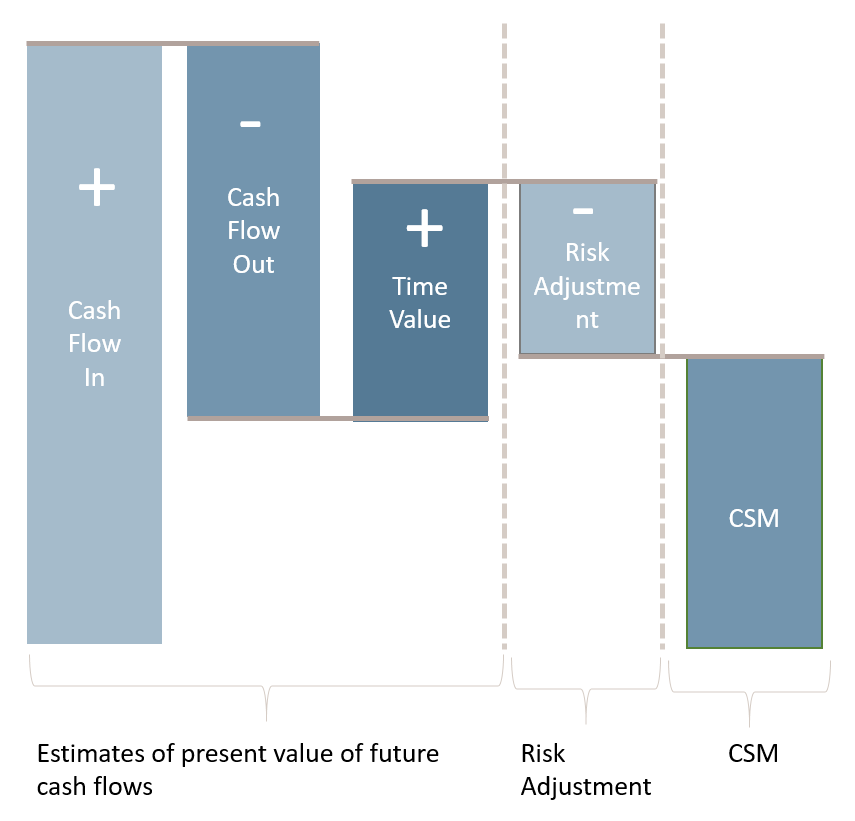

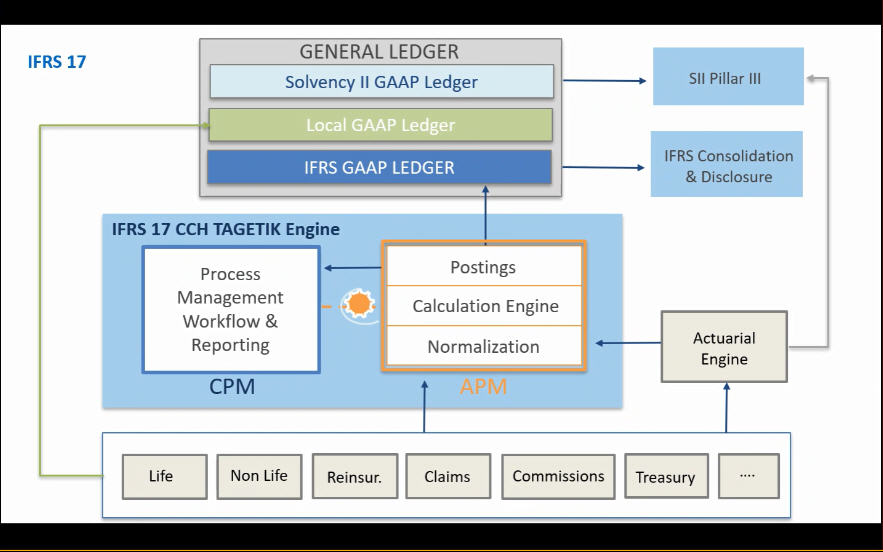

IFRS 17 introduces the general measurement model which is based on a risk-adjusted present value of future cash flows that will arise as the insurance contract is fulfilled. The following differences between the two Standards are noted. 132018 IFRS 17.

Contracts will be recognized as insurance expenses in the statement of profit or loss. Investors will be able to draw on more information on the profitability of new and in-force business. An illustration All amounts in CU thousands unless otherwise stated PwC IFRS 17 IFRS 9 and IFRS 7 allow a variety of measurement presentation and disclosure options and industry views of them continue to evolve.

What is the issue. Insurance Contracts the accounting model in one page. IFRS 17 Insurance Contracts Objective 1 IFRS 17 Insurance Contracts establishes principles for the recognition measurement presentation and disclosure of insurance contractswithin the scope of the Standard.

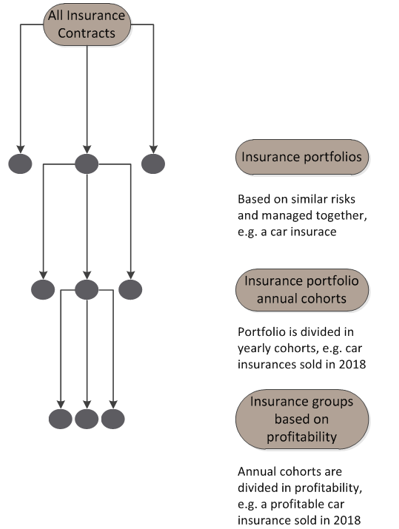

IFRS 17 establishes the principles for the recognition measurement presentation and disclosure of insurance contracts within the scope of the standard. Lenders would make this choice irrevocably at the portfolio level. IFRS 17 brings greater comparability and transparency about the profitability of insurance contracts and gives users more insights into an insurers financial health.

This article focuses on some of the complexities and. 7162020 IFRS 17 should be applied to annual reporting periods beginning on or after 1 January 2023 with earlier application permitted and the amendments should be applied at the same time. In addition at the time of this publication the IASB continues to discuss IFRS 17 concerns.

IFRS 17 replaces IFRS 4 which currently permits a wide variety of practices. IFRS 17 was issued by the IASB the Board on 18 May 2017. 262018 The Board proposes amending IFRS 17 and IFRS 9 to allow lenders to apply either standard to loans for which the only insurance cover is for the settlement of some or all of the borrowers obligations under the loan.

Balance sheet Insurance contract liability Profit from coverage to be. In addition IFRS 17 requires that insurance revenue excludes the deposits that represent the investment of the policyholder rather than an amount charged for services. However a closer look at IFRS 17 highlights some complexities that come with increased transparency and consistency in reporting.

What did the Board decide in March 2019. And Some service contracts such as separately priced warranties on. A The scope and definition of acquisition costs under the two Standards differ with IFRS 17 including a wider range of expenses compared to IFRS 152.

Under IFRS 17 compared to the treatment in IFRS 15 Revenue from Contracts with Customers. IFRS 17 brings new levels of transparency giving users more insight into an insurers financial health than ever before. In May 2017 the IASB finished its long-standing project to develop an accounting standard on insurance contracts and published IFRS 17 Insurance Contracts.

Insurance services rather than when it receives premiums and to provide information about insurance contract profits the company expects to recognise in the future. IFRS 17 will fundamentally change the accounting by all entities that issue insurance contracts and. Profit or loss Modifications for contracts with a variable fee Other comprehensive income optional Insurance finance expenses Changes in discount rates.

The objective of IFRS 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. IFRS 17 requires that insurance revenue should exclude those deposits that represent the investment of the policyholder rather than an amount charged for services. As such repayment of non- insurance component such as deposits will be treated as repayment of a liability.

IFRS 17 supersedes IFRS 4 Insurance Contracts and related interpretations and is effective for periods beginning on or after 1 January 2021 with earlier adoption permitted if both IFRS 15 Revenue from Contracts with Customers and IFRS 9 Financial instruments have also been applied. Additionally companies are required to present deposit repayments as settlements of liabilities instead of insurance expenses. IFRS 17 covers the accounting for insurance contracts issued reinsurance contracts acquired and investment.

Similarly IFRS 17 requires that companies present deposit repayments as settlements of liabilities rather than as insurance expenses. The objective of IFRS 17 is to ensure that an entity provides relevant information that faithfully represents those contracts.

The New Ifrs 17 Disclosure In Short What Needs To Be In The Financial Statement

The New Ifrs 17 Disclosure In Short What Needs To Be In The Financial Statement

Ifrs 17 Insurance Contracts Theactuary Net Actuarial Knowledge

Ifrs 17 Insurance Contracts Theactuary Net Actuarial Knowledge

Ifrs 17 Insurance Contracts Theactuary Net Actuarial Knowledge

Ifrs 17 Insurance Contracts Theactuary Net Actuarial Knowledge

The New Ifrs 17 Disclosure In Short What Needs To Be In The Financial Statement

The New Ifrs 17 Disclosure In Short What Needs To Be In The Financial Statement

Ifrs 17 Insurance Contracts Focus Areas For The Chief Finance Officers And Chief Executive Officers Life Insurers Baoa Botswana Accountancy Oversight Authority

Ifrs 17 A Challenge Ahead For Insurers Convista

Ifrs 17 A Challenge Ahead For Insurers Convista

Ifrs 17 General Measurement Model Gmm Legerity

Ifrs 17 General Measurement Model Gmm Legerity

Return Of Investment Ifrs17 Implementation Business Benefits Investing Digital Transformation

Return Of Investment Ifrs17 Implementation Business Benefits Investing Digital Transformation

Ifrs 17 A Challenge Ahead For Insurers Convista

Ifrs 17 A Challenge Ahead For Insurers Convista

Ifrs 17 Insurance Contracts Theactuary Net Actuarial Knowledge

Ifrs 17 Model Summarized What Are The Biggest Changes

Ifrs 17 Model Summarized What Are The Biggest Changes

Ifrs 17 Insurance Contracts Theactuary Net Actuarial Knowledge

Https Www Scor Com En File 33671 Download Token Ce8npbgz

Ifrs 17 Insurance Contracts Theactuary Net Actuarial Knowledge

Post a Comment for "Insurance Service Expense Ifrs 17"