Life Insurance 1099 Interest

See Topic 403 for more information about interest. Forms 1099-R and 1099-INT will be available on MyNYL or mailed to you by January 31 st each year.

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

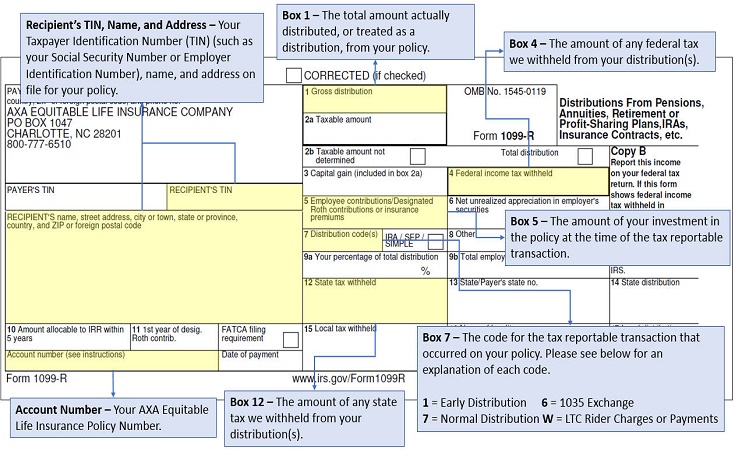

Form 1099-R is used to report designated distributions of a policys internal earnings gain that were previously untaxed.

Life insurance 1099 interest. While both forms report income that is generated by an insurance policy Form 1099-INT is used to report interest credited on certain policy proceeds. Think of these as capital gains if they had been held in a taxable investment account. 9152012 The deferred income on the policy is used to pay non-deductible interest.

You also could be hit with an additional tax on that interest if you are a high income earner. This usually happens because the insurance company took longer than legally permitted to distribute your money. When this happens the insurance company owes you interest on the money they held longer than legally allowed.

If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction. When the net policy value is eroded the company issues a 1099 for many years worth of earnings. Treasury issued in registered form or of a type offered to the general public or figures from which national income.

See the Instructions for Form 1009-LS for complete filing requirements. In some cases it has been. 2102021 Life insurance is a contract in which an insurer in exchange for a premium guarantees payment to an insureds beneficiaries when the insured dies.

If its tax exempt it will be in box 8. Do I report proceeds paid under a life insurance contract as taxable income. 12232019 That interest can be taxed at your ordinary income tax rate.

If you own an annuity the 1099-R could be the result of a full surrender a partial withdrawal or the transfer of the contract to a new owner. Mutual Trust Life Insurance Company produces 1099-INT and 1099-R forms that combine the taxable earnings for multiple policy numbers with the same payee social security number or tax ID number. If you are a policyowner with multiple policies you receive only one 1099-INT andor one 1099-R form if applicable.

View solution in original post. 652019 Please do enter the form in the 1099-INT section. However any interest you receive is taxable and you should report it as interest received.

If its taxable interest it will be in box 1 on your 1099-INT. You should receive a Form 1099-INT from the insurance company reporting your taxable interest Mullaney says. 642019 Because you received a Form 1099-MISC for the life insurance payout this indicates that it is taxable income to you.

3122014 1099-INT as interest income. The form 1099-INT can be from many institutions life insurance policies included. For example assume you owned a whole life policy with 100000 in cash value.

There are two types of 1099s 1099-INT and 1099-R. All you have to do is enter it as it appears if more than box 1 or other boxes are filled out select My form has more than just box 1 and enter the values form your form. The life insurance proceeds themselves will not cause you to receive a 1099.

532014 If you are receiving your life insurance proceeds on a payment plan you will be paid interest on the amount of the death benefit that has not yet been paid to you. Bolt from the blue 1099-R life. You could have gains reflected on a 1099-R and accumulated unpaid dividends on the 1099-INT.

Taxable interest is included on line 2b on your 1040 line 2a if it is tax exempt interest. 1162020 1099-INT reports interest payments. 1282021 Interest paid which has to be reported about a 1099-INT will consist of interest on bank deposits gathered dividends compensated by a life insurance provider indebtedness such as bonds debentures notes and certificates aside from those of the US.

10142020 Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. 2182021 File Form 1099-LS if you are the acquirer of a life insurance contract or any interest in a life insurance contract in a reportable policy sale. The interest not the payments just the interest will be charged income tax and generate a 1099.

Form 1099-INT is sent when you earn or receive interest that is reportable to the IRS. The CSV of the policy would reflect your premiums paid amount in Box 5 of the 1099-R and investment gains. 6222016 The problem of course is that the policy return is taxable while the policy loan interest is not deductible.

Form 1099-R is sent when distributions or other policy activity occurs that is reportable to the IRS.

Common Mistakes In Life Insurance Arrangements

Common Mistakes In Life Insurance Arrangements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

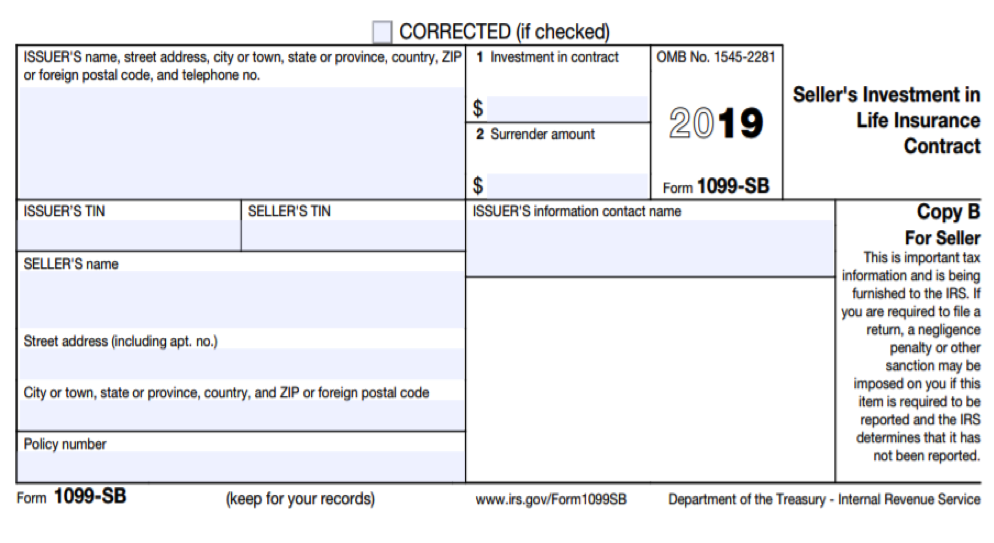

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

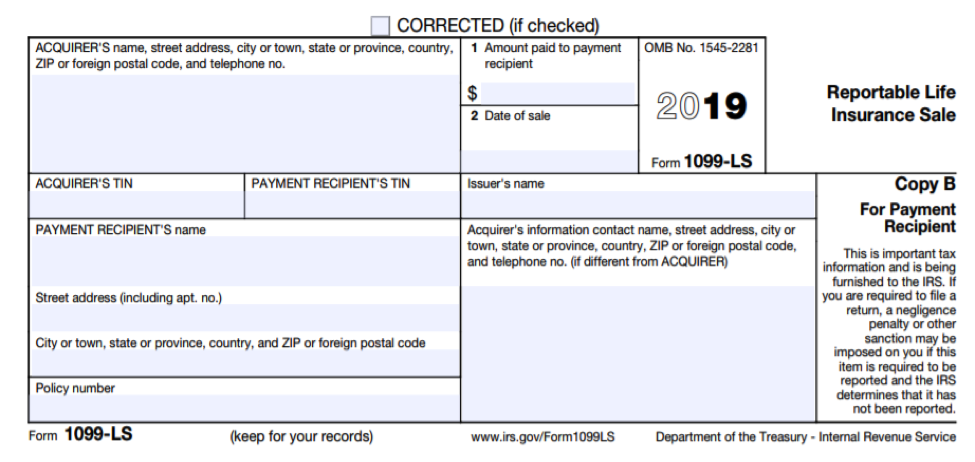

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Post a Comment for "Life Insurance 1099 Interest"