Insurance Payout For Rental Property Taxable

Property was not repaired other than to remove the fallen tree and cover up the roof. 2112019 Just like a normal insurance settlement compensation for medical bills and repair of property are not taxed in a lawsuit.

Https Www Efghermesresearch Com Opendownloads Saudi 20arabia 20insurance 20sector Pdf

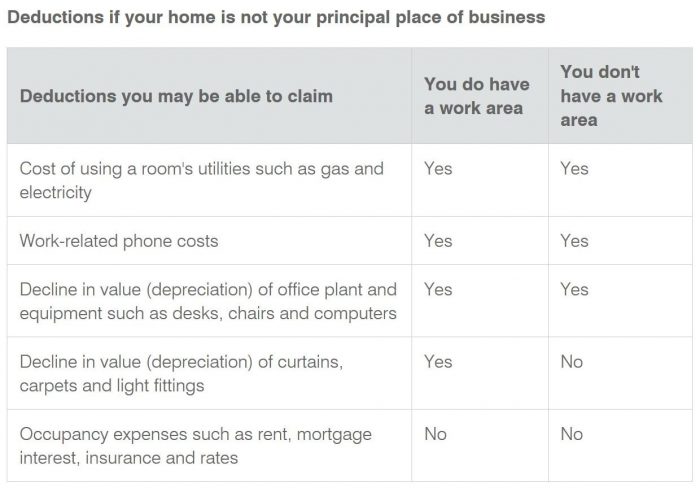

For example if part of your home is used for a home business or you have rented out a room.

Insurance payout for rental property taxable. 5142016 A word of caution about claiming deductions on a property for interest utilities and property taxes as examples when the property is under construction or being renovated. Generally goods and services tax GST doesnt apply to rental payments you receive. We did not claim and were not paid for any rental loss of rent income.

Generally if a rental unit is unavailable for rent. You must include them in your rental income. If its a sideline investment your losses are passive and may be.

If you report a property loss on your tax return however your insurance reimbursement affects how big a. If the loss is fully covered there is no deduction. Business property insurance proceeds taxable income rental property insurance proceeds taxable are insurance claims taxable income.

10162012 You do not pay National Insurance if youre not running a business - even if you do work like arranging repairs advertising for tenants and. The original basis of property is 68464. 11222020 Income of any type received from any source for residential rental real estate is reportable income.

While no one likes to pay for insurance knowing that business insurance premiums are tax deductible and that you can avoid paying taxes on the money that you receive from a claim make it easier to accept. 672019 I received 1787410 from an insurance claim on my rental property for water damage. A rental property owner may take a deduction for casualty losses only to the extent that the loss is not covered by insurance.

The Income Tax Act forces the capitalization of soft costs ie. You also cant claim credits for the GST included in any costs relating to the rental such as agents commission or repairs and maintenance on the premises. This is not as unusual as it.

If youre running a property rental business with profits of more than 5965 youll also need to pay Class 2 National Insurance. For example your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment. A property owner cant avoid this rule by not filing an insurance.

If your profits are less than this you can make voluntary National Insurance payments that will enable you to claim the full State Pension. Recovery from Insurance Date of Taxable Rental Income Rental income is taxable from the date it is due and payable to the property owner and not the date of actual receipt. The insurance proceeds do not need to be reported as they were less than your repairs.

Theres really only one situation where insurance compensation is taxable and thats if the settlement exceeds the original cost of the damaged property. The costs must be added to the cost of the property and depreciated over time in these cases. 10312017 The Role of Insurance After a Disaster.

An insurance payout for a property that was used to produce income will have tax consequences. It was then sold for 3000. Insurance reimbursement isnt usually taxable income.

12162020 Principle payments are not. Any assessable amounts relating to limited recourse debt arrangements involving your rental property. Rental income was due in 2020 but was only paid in 2021.

182021 Expenses paid by tenant occur if your tenant pays any of your expenses. We had some hail damage and the insurance paid for the repairs. However many types of payout that you may receive as a result of a legal settlement are taxable whether the case is ultimately settled in or out of court.

If you will be rebuilding then the payout amount is included in the total of all rental income received for the tax year you received the payout. I had an insurance pay out for total loss at 119538 when a large tree fell on the house. The IRS regards it as compensation for losses youve suffered -- a way to restore your property to its former condition.

You will need to reduce your repair expenses by the insurance so that the total repair expenses deducted for the damage is 288190. You can deduct the expenses if they are deductible rental expenses. Insurance lawn care and local taxes are deductible.

Its taxable to the extent it exceeds your cost basis. However if you use the extra money to purchase a new property within two. How should I report on turbotax.

If your insurance payout is higher than either total the extra funds are subject to taxation. 9262018 The ATO rental property guide says that payouts for insurance claims must be declared. The insurance payout amount will be relevant when you work out if you have a capital gain or capital loss to include in your tax return.

Life Insurance In Estate Planning Good Times

Life Insurance In Estate Planning Good Times

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Captive Insurance Considerations In Taxation Ppt Download

Captive Insurance Considerations In Taxation Ppt Download

Http Www Fpsbindonesia Net Download Keyman Intro Keyman Goldenhandcuff Pdf

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Smart Retirement Today Bigger Better Living By Design

Smart Retirement Today Bigger Better Living By Design

Covid 19 What Remote Working Means For Your Income Tax Return Wybenga Partners

Covid 19 What Remote Working Means For Your Income Tax Return Wybenga Partners

Guide To Annuity Fees Fidelity Investments Annuity Investing Shoppers Guide

Guide To Annuity Fees Fidelity Investments Annuity Investing Shoppers Guide

Are Insurance Payments Tax Deductible Infographics Article

Are Insurance Payments Tax Deductible Infographics Article

Indonesia Personal Income Tax Indonesia Taxation

Indonesia Personal Income Tax Indonesia Taxation

How To Claim Income Tax Reliefs For Your Insurance Premiums

How To Claim Income Tax Reliefs For Your Insurance Premiums

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

How To Claim Income Tax Reliefs For Your Insurance Premiums

How To Claim Income Tax Reliefs For Your Insurance Premiums

Printable Power Of Attorney Fresh Free General Power Of Attorney Tennessee Form Adobe Pdf Power Of Attorney Power Of Attorney Form Attorneys

Printable Power Of Attorney Fresh Free General Power Of Attorney Tennessee Form Adobe Pdf Power Of Attorney Power Of Attorney Form Attorneys

When Are Car Insurance Settlements Taxable Insurance Com

When Are Car Insurance Settlements Taxable Insurance Com

Http Www Fpsbindonesia Net Download Keyman Intro Keyman Goldenhandcuff Pdf

Post a Comment for "Insurance Payout For Rental Property Taxable"