Is Life Insurance An Allowable Rental Expense

112015 Life insurance premiums are not allowed anyway The revenue manuals CFM33060 and BIM44525 indicate that life insurance premiums to secure a loan are not allowable deductions in the case of a company it is specifically not incidental costs of loan finance. Property insurance including buildings insurance rent insurance etc are all allowable expenses for landlords.

Monthly Budget Planner 2 Months Budget Template Excel Budget Template Excel To Help You Manag Budget Template Budget Planner Template Excel Budget Template

Monthly Budget Planner 2 Months Budget Template Excel Budget Template Excel To Help You Manag Budget Template Budget Planner Template Excel Budget Template

Mortgage Protection Insurance is a life insurance policy that pays off your mortgage on our rental property if you or your partner dies before the mortgage is paid off.

Is life insurance an allowable rental expense. Cutting and fitting rugs draperies and curtains. 1142019 Any expenses that you incurred before you started renting may still be allowable if they would have been tax deductible after the rental business started like repairs neglected by the previous owner. 10000 or more before allowable expenses.

List of allowable expenses on a rental property. That would be a gegitimate expense. The alternative would be keyman insurance.

Advertising costs for your letting your property. 8272008 The two insurances that are allowable are house insurance fire theft fixtures fittings and furniture the other is the life assurance known as a term insurance it is the one that decreases in value as the mortgage goes down. Drivers license and use taxes.

Typically these will be policies paid for by a company such as relevant life insurance or keyman insurance. Ground rents and service charges and council tax are also allowable. Insurance and service charges.

732011 Straight life insurance would presumably be for the benefit of his family in the event of something happening to him out there. Some expenses you incur are not deductible. Whether you need to fill in a tax return will depend on.

Business rates or council tax. For more information on what we consider a current or capital expense go to Current expenses or capital expenses. In this case it allows co-owners of a business to protect themselves in the event that one owner leaves or diesThese agreements can be funded with life insurance policies either purchased individually by each co-owner or by the company.

And the benefits of relevant life insurance can save you huge amounts on tax. Take a common example of life insurance taken out for a business loan which pays only the loan company on death of the insured. Both relevant life insurance and keyman insurance can be tax-deductible as the policy will be.

11132013 You will require a Declaration of Trust to define the beneficial interest in the property then a Form 17 to HMRC. However take out an insurance policy to pay off a loan taken privately that was used to inject capital into the business and it is not allowable as the beneficiary is the persons. Phone calls and charges in connection with your rental business.

5242017 The list below outlines what expenses are allowed potentially with an adjustment for private use. Medical insurance for landlords. Key man insurance can help you save on corporation tax or tax on the payout depending on how the money is used.

The only way that could be considered a business expense is if it was part of his remuneration assuming he is operating through a company and he was then taxed on it as income. Legal fees for your rental business. 10192015 more than 2500 after allowable expenses.

And insurance against damage to or loss of personal property while in transit A. Necessary and reasonable expenses normally incident to relocation such as disconnectingconnecting household appliances. Yes some forms of life cover can be tax-deductible.

A buy-sell agreement operates along similar lines as key person insurance. Rent paid to a superior landlord. Car insurance for vehicles not used in the rental business.

The policy has a term identical to your mortgage and the payout reduces in line with your mortgage. Stationary and admin costs. Life insurance is not a deductible expense.

Repairing water leakages gas leaks burst pipes electrical problems. They are not retrospective. Save money and claim life insurance as a business expense.

On approaching a disposal the DofT can be changed to ensure the CG attributable to your share mops up you CG allowance. By running a life insurance policy through the business you can save money. Forfeited utility fees and deposits.

1302019 Are buy-sell agreements a deductible as a business expense. The two basic types of expenses are current expenses and capital expenses. You can deduct any reasonable expenses you incur to earn rental income.

In this case the expenses can be claimed as if they were incurred on the first day of the business.

So Many Want To Learn To Be Rich And Are Willing To Pay Thousands On Scams Or On Courses That Business Ideas Entrepreneur Business Mentor Business Motivation

So Many Want To Learn To Be Rich And Are Willing To Pay Thousands On Scams Or On Courses That Business Ideas Entrepreneur Business Mentor Business Motivation

Year End Tax Plan Template Sample Financial Savvy How To Plan Money Management

Year End Tax Plan Template Sample Financial Savvy How To Plan Money Management

Pin By Lydia Puller Where Plant Bas On Real Estate Real Estate Tips Real Estate Information Real Estate Career

Pin By Lydia Puller Where Plant Bas On Real Estate Real Estate Tips Real Estate Information Real Estate Career

Protect Your Security Deposit To Protect Yourself And Avoid Any Misunderstandings Make Sure Your Lease Or Ren Being A Landlord Legal Advice Misunderstandings

Protect Your Security Deposit To Protect Yourself And Avoid Any Misunderstandings Make Sure Your Lease Or Ren Being A Landlord Legal Advice Misunderstandings

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Income Tax Preparation Tax Preparation Tax Prep Checklist

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Income Tax Preparation Tax Preparation Tax Prep Checklist

Ce Qui Banque Le 1er Aout Contre Le Compte Des Menages Tax Accountant Certified Accountant Tax Advisor

Ce Qui Banque Le 1er Aout Contre Le Compte Des Menages Tax Accountant Certified Accountant Tax Advisor

Allowable Expenses The Complete Guide For Finance Professionals

Allowable Expenses The Complete Guide For Finance Professionals

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge Tax Forms Income Tax Income

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge Tax Forms Income Tax Income

Success Motivation Inspiration Entrepreneur Business Love Motivationalquotes Goals Quotes Lifest Business Ideas Entrepreneur Financial Tips Investing

Success Motivation Inspiration Entrepreneur Business Love Motivationalquotes Goals Quotes Lifest Business Ideas Entrepreneur Financial Tips Investing

A Guide To Allowable Expenses For A Limited Company

A Guide To Allowable Expenses For A Limited Company

What Are Allowable Deductions Exceldatapro

What Are Allowable Deductions Exceldatapro

What Are Disallowable Expenses Go Self Employed Self Small Business Bookkeeping Small Business Plan

What Are Disallowable Expenses Go Self Employed Self Small Business Bookkeeping Small Business Plan

Home Buying Tax Deductions Home Buying Tax Deductions Real Estate Advice

Home Buying Tax Deductions Home Buying Tax Deductions Real Estate Advice

Pin By Melissa Gonzalez On Inspirational Business Money Investing Money Business Ideas Entrepreneur

Pin By Melissa Gonzalez On Inspirational Business Money Investing Money Business Ideas Entrepreneur

Application Area Hbv Wall Walls With Wood Concrete Composite System Concrete Wood Concrete Wood

Application Area Hbv Wall Walls With Wood Concrete Composite System Concrete Wood Concrete Wood

Landlord Tax Changes What Are Allowable Expenses Foxtons Blog News

Landlord Tax Changes What Are Allowable Expenses Foxtons Blog News

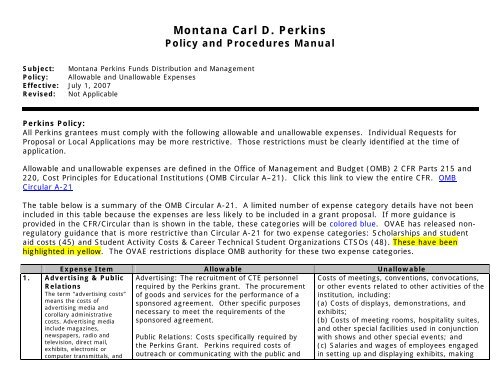

General Expenditures Examples Of Allowable And Unallowable Costs Child Nutrition Nysed

Post a Comment for "Is Life Insurance An Allowable Rental Expense"