Insurance Expense Definition

4212016 A claim expense includes all the costs paid by the insurance company in the form of claims adjustment expenses. The amount paid is charged to expense in a period reflecting the consumption of the insurance over a period of time.

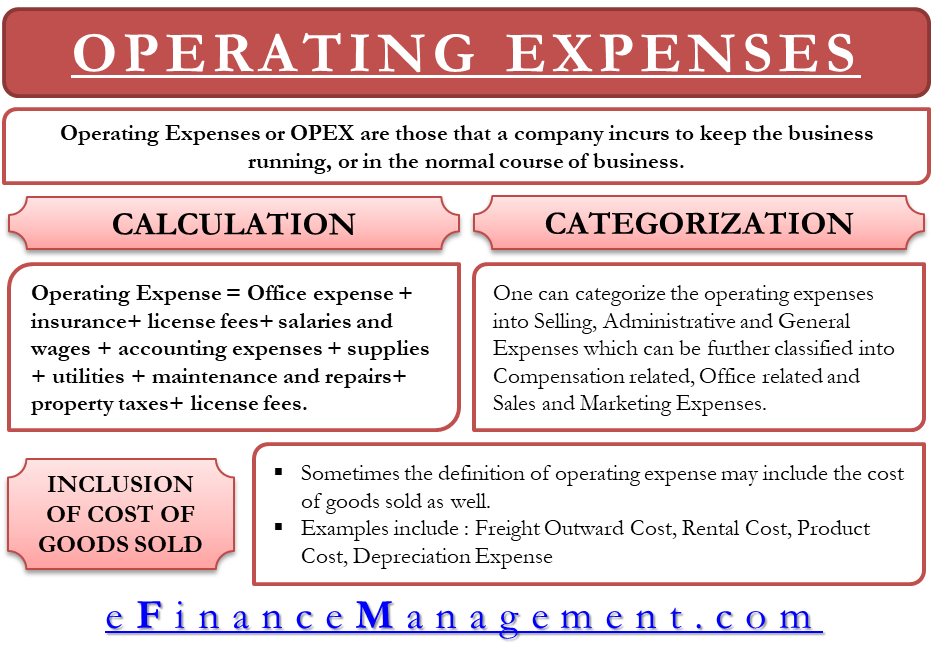

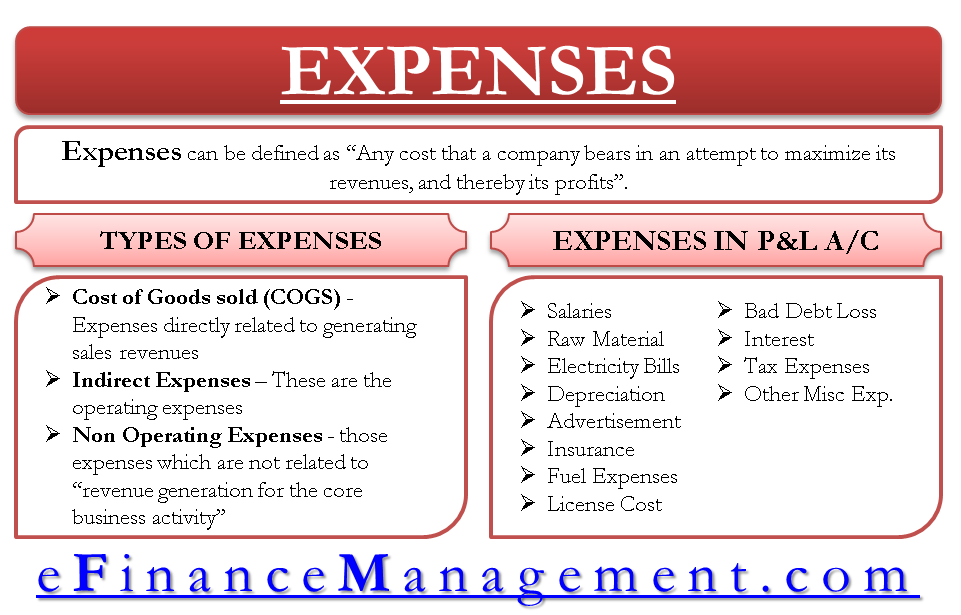

Operating Expenses Definition Explanation And Example List

Operating Expenses Definition Explanation And Example List

As a policyholder the organization can select coverage for a vast array of events.

Insurance expense definition. Regulations for legal expenses insurance state that under such a policy the insured person has the right to choose his own lawyer. If the expense is instead related to employees in the production area the. 5102017 Health insurance expense is the expense incurred by a business to pay for its portion of the medical insurance of its employees.

12152020 Extra expense insurance is a form of commercial insurance that pays for a policyholders additional costs while recovering from a major disruption. 942019 In health insurance your out-of-pocket expenses include deductibles coinsurance copays and any services that are not covered by your health plan. GENERAL INSURANCE EXPENSES 1.

Insurance expense definition The amount of insurance that was incurredused upexpired during the period of time appearing in the heading of the income statement. 8302020 What Is Final Expense Insurance. Though insurance is an indirect factor in operating expenses it still falls under it because it is associated with the operation and maintenance of the business.

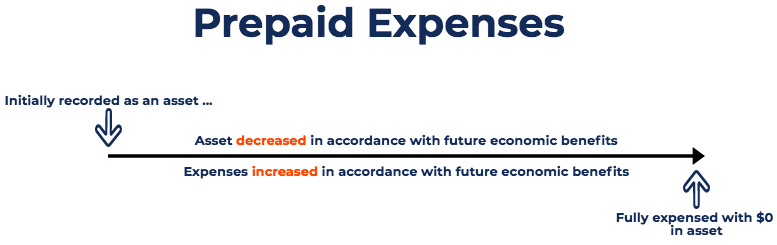

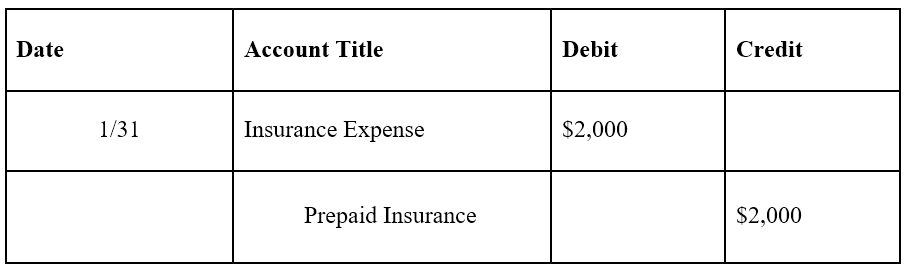

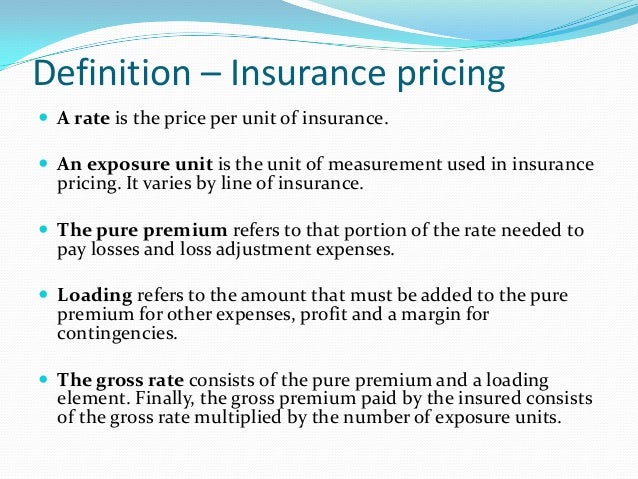

The amount of insurance premiums that have not yet expired should be reported in the current asset account Prepaid Insurance. 8232019 Insurance expense is the amount that a company pays to get an insurance contract and any additional premium payments. 5222015 Expense ratio refers to the percentage of premium that insurance companies use for paying all the costs of acquiring writing and servicing insurance and reinsurance.

The commission offered by an insurance company in respect of a particular type of business. Extra expense insurance coverage applies to the. The insurance company also sets a maximum amount that youll have for medical expenses on your own called an out-of-pocket maximum.

The payment made by the company is listed as an expense for the accounting period. 12152020 Insurance expense is that amount of expenditure paid to acquire an insurance contract. 9262017 Insurance expense is a charge a business incurs to protect its operations against adverse commercial or life events.

Others group it under inventory costs since they are associated with keeping inventory at. Definition of Insurance Expense Under the accrual basis of accounting insurance expense is the cost of insurance that has been incurred has expired or has been used up during the current accounting period for the nonmanufacturing functions of a business. Final expense insurance is a whole life insurance policy that has a small death benefit and is easier to get approved for.

Insurance Expenses means any Insurance Proceeds i applied to the repair of the related Leased Vehicle ii released to the related Lessee in accordance with applicable law or the Customary Servicing Practices or iii representing other related expenses incurred by the Servicer that are not otherwise included in Liquidation Expenses or Disposition Expenses and recoverable by the. General Legal expenses insurance is insurance coverage against expenses incurred when you need to seek legal advice or pay for a lawsuit. Join PRO or PRO Plus and Get.

INTRODUCTION 11 BACKGROUND The overall cost in expense terms of running an insurance operation is the total of the amount of managemen t expenses incurred and of the commission paid to intermediaries. 1132021 Final expense insurance is a whole life insurance policy with a small death benefit specifically marketed to help with the cost of the insured individuals funeral. Insurance companies typically follow two methods for measuring their expense ratios.

The trade method where insurance companies divide their expenses by the written premiums or. In most cases business owners and insurance agents classify insurance as operating expense. Underwriting Expense 1 The cost incurred by an insurer when deciding whether to accept or decline a risk.

Final expense insurance is relatively easy to qualify for since it does not require a medical exam. May include meetings with the insureds or brokers actuarial review of loss history or physical inspections of exposures. For a property and casualty insurer it would include all expenses for hiring an investigator to take pictures or document the activities of.

What are out-of-pocket expenses. Premiums for final expense insurance tend to be affordable. If the expense relates to employees in the selling and administrative area the expense is charged in that portion of the income statement.

The company signs a contract with an insurance company and agrees to pay periodic premiums in return for risk protection.

Direct Indirect Expenses Definition Examples Video Lesson Transcript Study Com

Direct Indirect Expenses Definition Examples Video Lesson Transcript Study Com

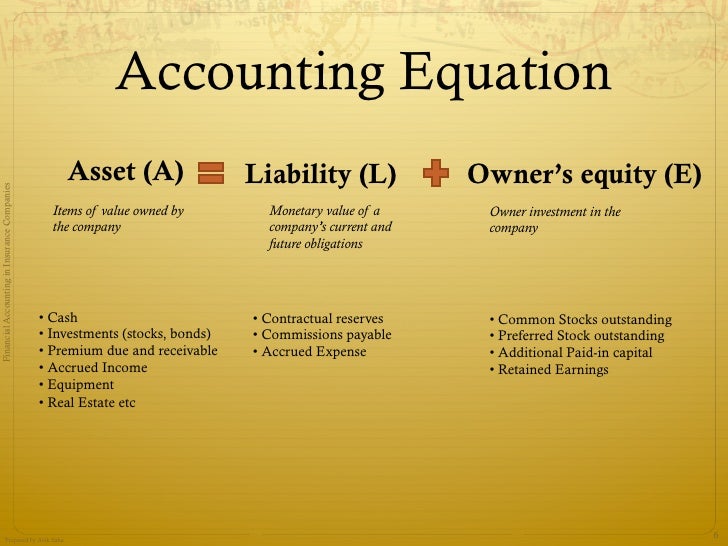

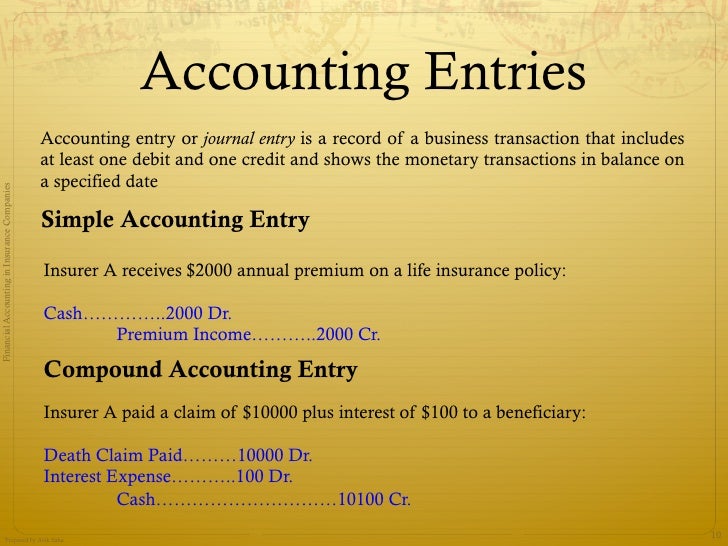

Accounting In Insurance Companies Basic Concepts

Accounting In Insurance Companies Basic Concepts

Operating Expenses Meaning Importance And More

Operating Expenses Meaning Importance And More

Insurance Premium Expired Adjusting Entry

Insurance Premium Expired Adjusting Entry

Combined Ratio In Insurance Definition Formula Calculation

Combined Ratio In Insurance Definition Formula Calculation

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

Cost Insurance And Freight Cif Definition Rules How It Works

Cost Insurance And Freight Cif Definition Rules How It Works

Prepaid Expense Examples Step By Step Guide

Prepaid Expense Examples Step By Step Guide

Accounting In Insurance Companies Basic Concepts

Accounting In Insurance Companies Basic Concepts

Full Coverage Car Insurance Cost Of 2020 Insurance Com

Full Coverage Car Insurance Cost Of 2020 Insurance Com

Non Operating Expenses Meaning Examples Top 12 List

Non Operating Expenses Meaning Examples Top 12 List

Other Expenses Definition List Of Other Expenses With Examples

Other Expenses Definition List Of Other Expenses With Examples

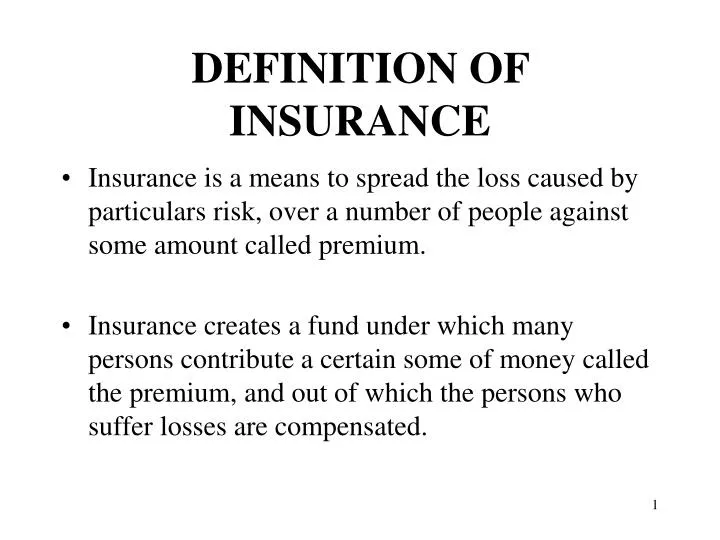

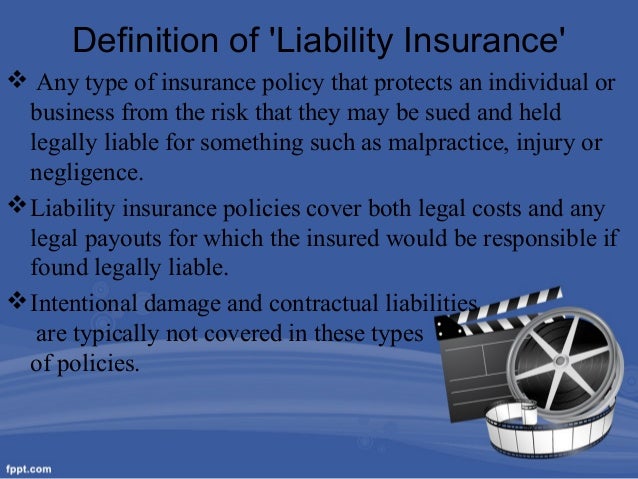

Ppt Definition Of Insurance Powerpoint Presentation Free Download Id 5198498

Ppt Definition Of Insurance Powerpoint Presentation Free Download Id 5198498

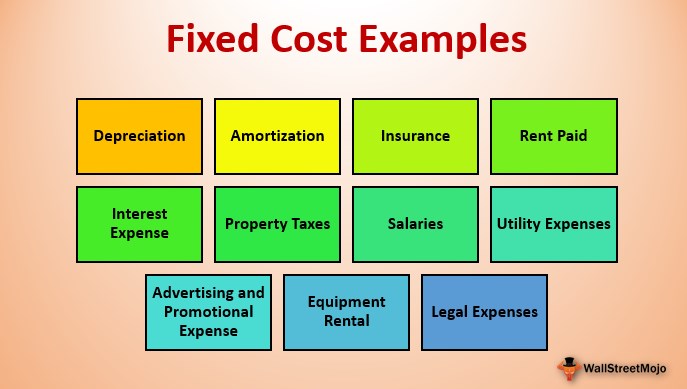

Fixed Cost Examples Top 11 Examples Of Fixed Cost With Explanation

Fixed Cost Examples Top 11 Examples Of Fixed Cost With Explanation

/AppleISdec2018OpCosts-5c6edec5c9e77c000151b9d2.jpg)

Post a Comment for "Insurance Expense Definition"