1099 Disability Insurance

You must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer. Even if you have the most cost-effective DI policy likely long-term disability insurance the monthly premiums may cost as much as much as 1 to 3 of your salaryUnfortunately you cannot deduct these disability insurance premiums on your taxes.

Are Disability Insurance Payments Taxable 941geary Com

Self-employed individuals with significant savings may opt to purchase only long-term disability insurance.

1099 disability insurance. Youll need to decide if the rewards outweigh the risks. 4242020 Disability insurance DI covers a certain percentage of your income if you cant work because of injury or illness. 662019 Box 6 of the 1099-MISC - Enter payments of 600 or more made in the course of your trade or business to each physician or other supplier or provider of medical or health care services.

9162019 I work primarily as a 1099 independent contractor or am a freelancer. The 1099 shows the entire amount of settlement. Disability insurance for self-employed individuals.

522019 Our 1099 Advantage Plan provides long- and short-term disability insurance as well as life insurance accident coverage and other benefits. Ask whoever provides the insurance. Disability Insurance Proceeds 1 Question.

If you still dont agree with the amount call the EDD at 1-866-401-2849 to speak to a representative. To enter this distribution into TaxSlayer Pro from the Main Menu of the Tax Return Form 1040 select. Its irreverent and humorous attitude combined with polished graphics and professional design make it much more fun to read than most web sites about micro-business.

The employer issues a 1099 statement at the end of the tax year rather than a W2. This is done through financial underwriting. The plan provides group benefits to independent contractors regardless of their medical history or a financial review.

4262020 As you can see being a 1099 worker carries with it both advantages and disadvantages. IRAs annuities pensions insurance contracts survivor income benefit plans permanent and total disability payments under life insurance contracts charitable gift annuities etc. It might be shown on your W-2.

Property damage or bodily injury that your business causes. Your age health marital status and other factors may figure into your decision. Disability insurance is the toughest kind of coverage for independent professionals to secure say underwriters.

How do I deduct the 40 legal fees from the 1099 amount. Your employer your union or the insurance company. Reputational harm as a result of malicious prosecution slander libel and more.

4232019 The 1099 Advantage Plan provides long- and short-term disability insurance as well as life insurance wealth preservation accident coverage and other benefits. Therefore a key part of the underwriting process and a determining factor of your premium is how much you earn. Include payments made by medical and health care insurers under health accident and sickness insurance programs.

112020 It depends on what kind of insurance it is. 1182019 Short-term disability for independent contractors presents a unique twist. 4162013 Received a 1099 from Disability Insurance Company after having to appeal and sue for settlement on a disability claim.

Also report on Form 1099-R death benefit payments made by employers that are not made as part of a pension profit-sharing or retirement plan. Short-term disability insurance typically pays for up to 12 weeks. Company sent check to lawyers and I received from lawyers the balance after paying lawyer fees.

What Does Contractors General Liability Insurance Cover. So yes it is for payments for medical services. The answer will change depending on whether the payments are from a disability insurance policy employer-sponsored disability insurance policy a workers compensation plan or Social Security disability.

This plan is highly customizable adaptable to a wide spectrum of specific needs and situations and helps you protect your human capital. Is the long-term disability I am receiving considered taxable. Employers pay independent contractors who are self-employed.

Long-term disability provides payments for an inability to work after short-term disability insurance ends usually beginning in week 13. 9112018 Disability insurance replaces around 60 of your pre-tax income while youre disabled and cant work. See Box 1 later.

Employers are not required to offer benefits to 1099 contractors but they can. If you received Unemployment Insurance benefits became disabled and began receiving Disability Insurance DI benefits you can confirm the amount listed on your Form 1099G by accessing your UI Online account. 142021 Life Insurance.

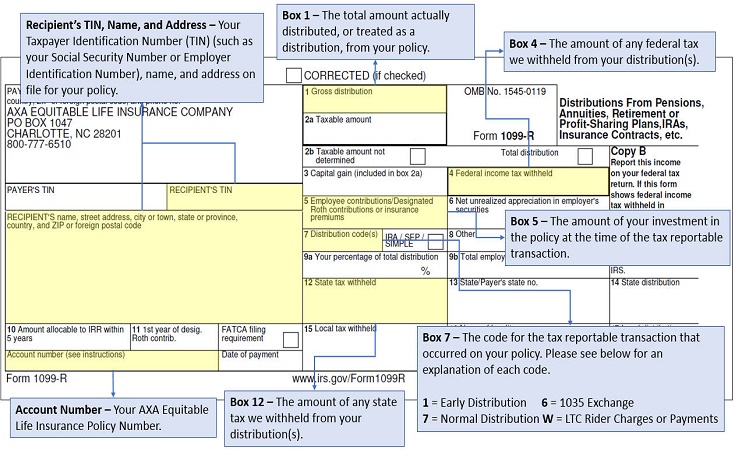

A distribution that has been made to an individual as a result of their disability should be reported to the taxpayer on a Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. General liability insurance for contractors which you can think of as 1099 insurance can help cover claims of. It could be one of several 1099-series forms or it might not be a 1099-series form at all.

Only you can decide which is the best option for you. 6142017 The answer to the question are disability payments taxable is thisHow disability payments are taxed depends on the source of the disability income. 1099 is a webzine for and about self-employed professionals.

Disability insurance benefits are based on a percentage of your income.

Irs Form 1099 R Box 7 Distribution Codes Ascensus

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

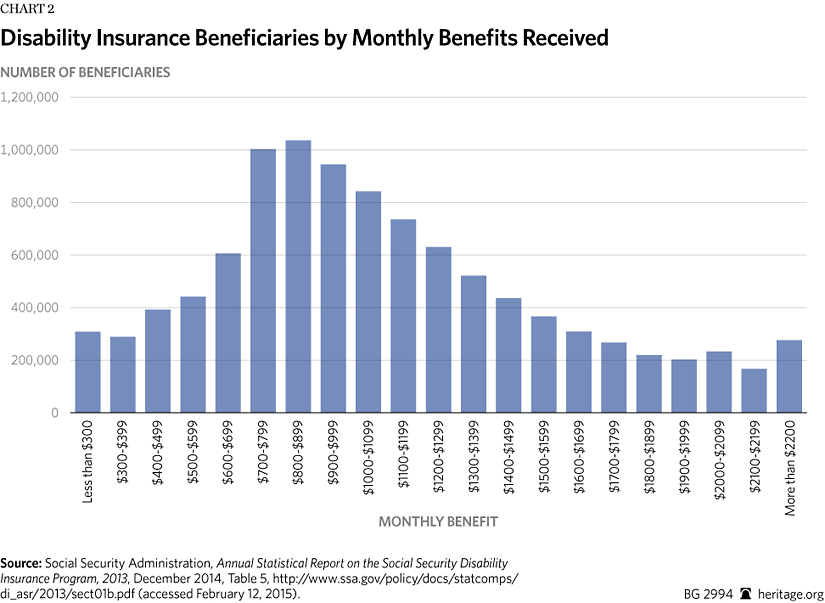

What Is Social Security Disability Insurance An Ssdi Primer The Heritage Foundation

What Is Social Security Disability Insurance An Ssdi Primer The Heritage Foundation

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Reporting Policy Benefits To The Irs

Reporting Policy Benefits To The Irs

.jpg) Division Of Temporary Disability And Family Leave Insurance Do You Need To Download A 1099 G

Division Of Temporary Disability And Family Leave Insurance Do You Need To Download A 1099 G

Disability Insurance For 1099 Employees Hines Life Insurance

Disability Insurance For 1099 Employees Hines Life Insurance

Disability Awareness Month Walks Like A Duck Talks Like A Duck But Maybe It S Not As Easy As That Balanced Financials

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

Sample 4 R Form Filled Out Ten Top Risks Of Sample 4 R Form Filled Out

Sample 4 R Form Filled Out Ten Top Risks Of Sample 4 R Form Filled Out

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Welcome To General Assembly Retirement System

Welcome To General Assembly Retirement System

Post a Comment for "1099 Disability Insurance"