Prepaid Insurance Is An Expense Already Incurred But Not Paid

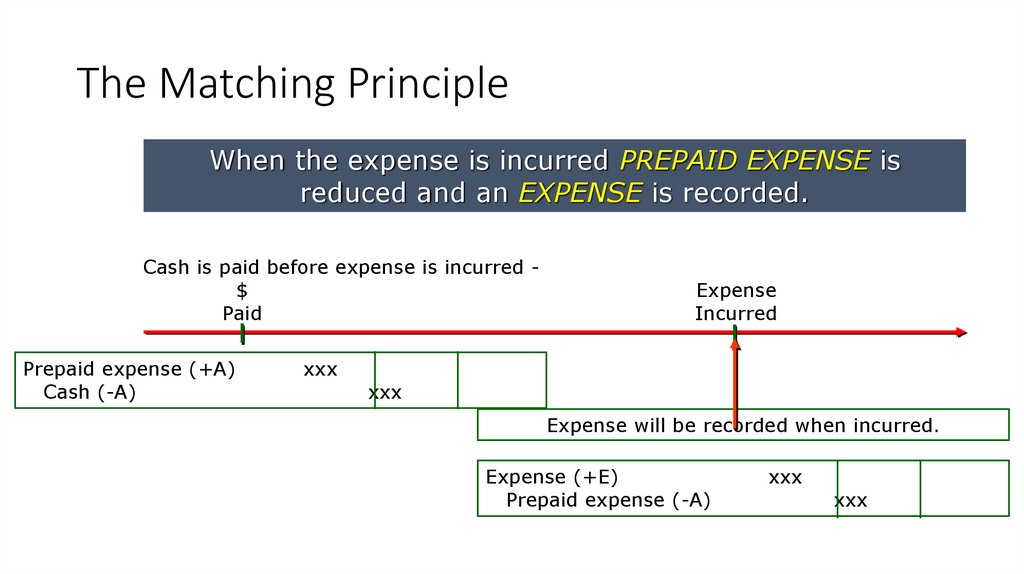

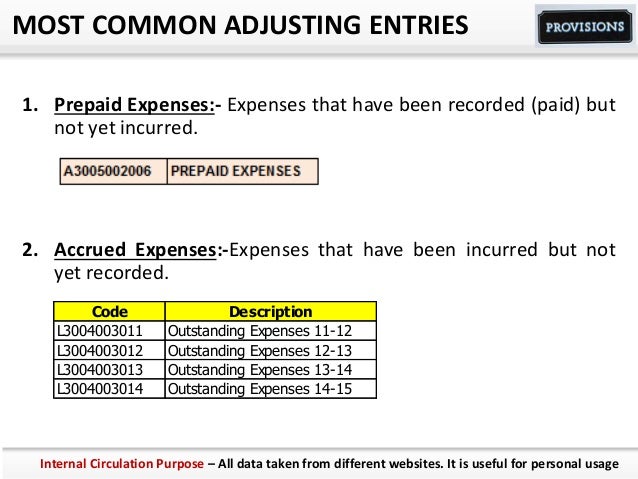

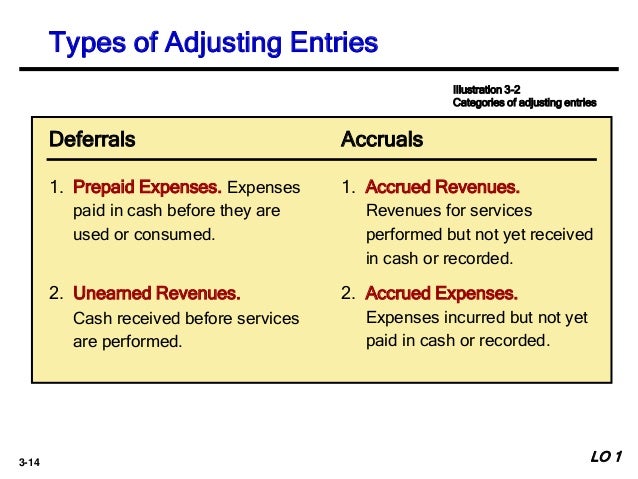

Debit insurance expense for x months in. Prepaid Expenses- Expenses that have been recorded paid but not yet incurred.

This records the prepayment as an asset on the companys balance sheet such as prepaid insurance and debits an expense account on the income statement such as insurance expense.

Prepaid insurance is an expense already incurred but not paid. Therefore there is not a contractual obligation. Incurred and already paid or recorded. Prepaid expense is expense paid in advance but which has not yet been incurred.

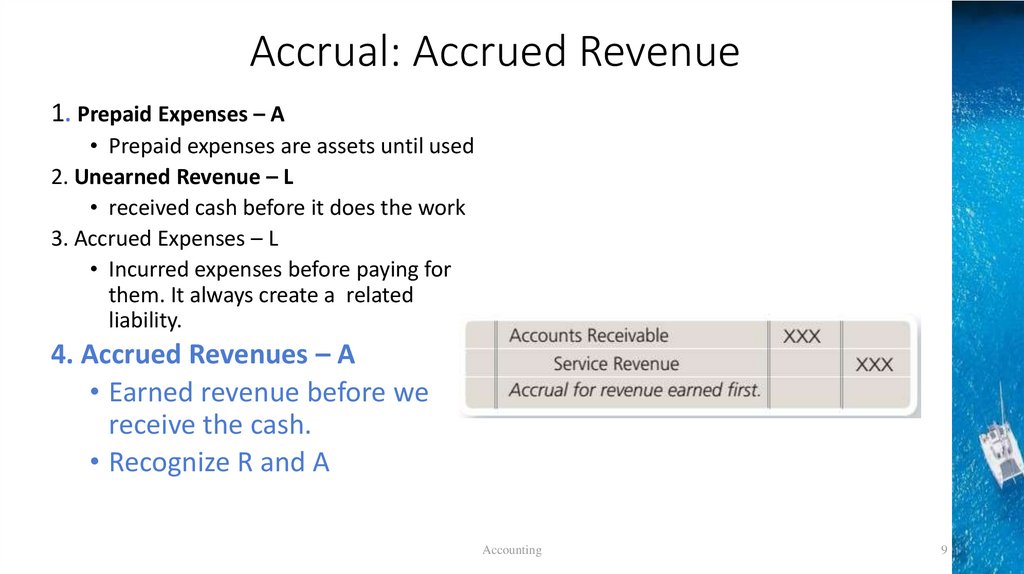

Accrued Expenses-Expenses that have been incurred but not yet recorded. 7252020 Prepaid Insurance is one type of prepaid expenses that we commonly see in the current assets section in the Balance Sheet. Initial journal entry for prepaid insurance.

Expenses incurred but not yet paid or recorded are called Aprepaid expenses. When the asset is eventually consumed it is charged to expense. A Initially recording advance payment of an insurance premium to Prepaid insurance instead of Insurance expense.

The best entries until that time are. 10252020 For example insurance is a prepaid expense because the purpose of purchasing insurance is to buy proactive protection in case something unfortunate happens in the future. When the asset is eventually consumed it is charged to expense.

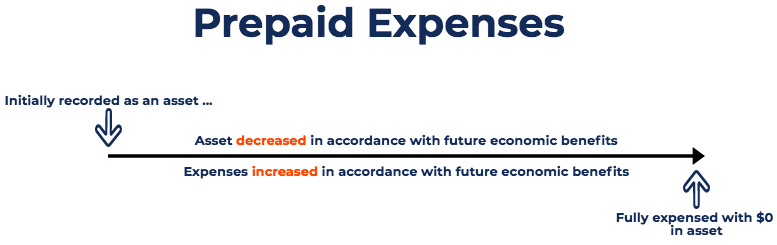

These statements are key to both financial modeling and accounting. The payment made pertains to future reporting period and so it is recorded as an asset. Definition of Prepaid Expenses A prepaid expense is an expenditure that is paid for in one accounting period but for which the underlying asset will not be entirely consumed until a future period.

It refers to the advance payment of insurance premiums to the insurance company for insurance coverage. Prepaid Insurance is the amount of insurance premium paid by the company in an accounting period that didnt expire in the same accounting period and therefore the unexpired portion of this insurance will be shown as an asset in the balance sheet of the company. Since cost is huge they are written off over a period of time corresponding to its benefit.

Prepaid expenses are expenses for which the business has already incurred the cost but not got the benefit. In fictitious asset the cost is written over a period of time. O paid and recorded in an asset account before they are used or consumed.

At the end of the year the amount paid will be a charge in the income statement and prepaid expenses will be reduced. 912020 Prepaid expenses represent prepayment of an expense and hence it is debited and the cash account is credited. No Prepaid Expense is Not a Fictitious Asset.

B Failure to record interest expense incurred but not yet paid. The most common form of an adjusting entry for prepaid expense would be for the used portion of an insurance premium. Accrued expenses are liability icurred but not paid for eg rent and accrued revenue is an income incurred but not paid for.

Unearned revenues are cash received in advance. Unexpired insurance premiums are reported as Prepaid Insurance an asset account. Meaning of Prepaid Expense A prepaid expense is an expense incurred by an entity in advance before receiving such goods or services.

If consumed over multiple periods there may be a series of corresponding charges to expense. A prepaid expense is also known as a prepaid asset. 4172014 I agree that there is no prepaid expense until the invoice is paid because the company can cancel for non-payment.

12132020 Definition of Prepaid Expenses A prepaid expense is an expenditure paid for in one accounting period but for which the underlying asset will not be consumed until a future period. 1062019 Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. O paid and recorded in an asset account after they are used or consumed.

Paid and recorded in an asset account before they are used or consumed. Incurred but not yet paid or recorded. Prepaid insurance - expenses paid and recorded as an asset prior to being used.

Incurred and already paid or recorded. Prepaid expenses are expenses being paid before they are incured eg insurance. 122016 MOST COMMON ADJUSTING ENTRIES 1.

These assets are not real. O incurred but not yet paid or recorded. Paid and recorded in an asset account after they are used or consumed.

If the retailer has incurred some insurance expense but has not yet paid the premiums the retailer should debit Insurance Expense and credit Insurance Premiums Payable. Expense must be recorded in the accounting period in which it is incurred.

Methods Of Revenue And Expense Calculations Online Presentation

Methods Of Revenue And Expense Calculations Online Presentation

Provisions In Accounting Prepaid Expenses

Provisions In Accounting Prepaid Expenses

Prepaid Expenses Financial Edge

Prepaid Expenses Financial Edge

Accounting Prezentaciya Onlajn

Accounting Prezentaciya Onlajn

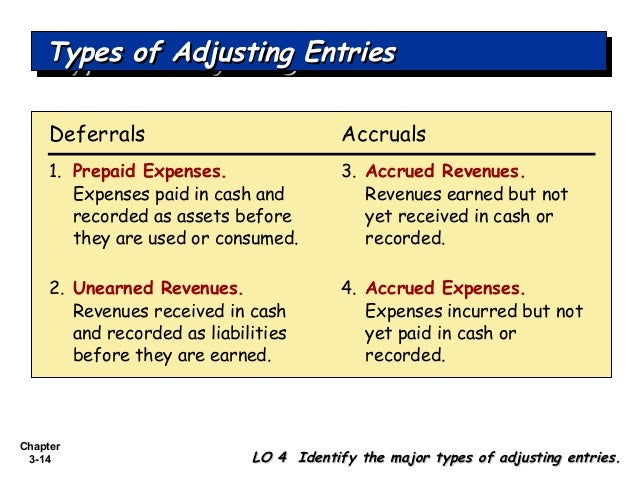

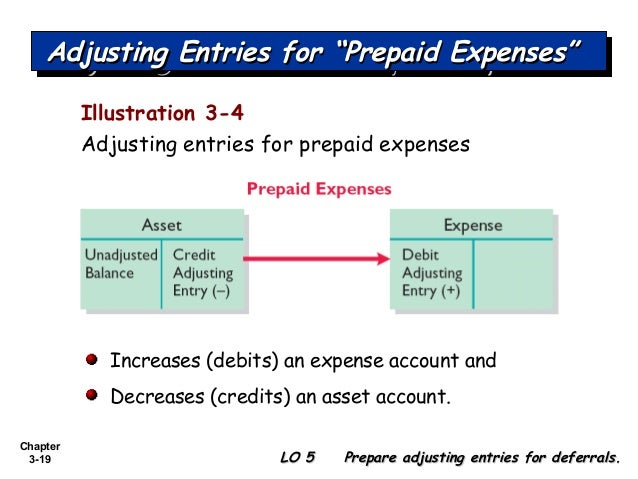

Accrual Accounting Concepts Chapter 3 Online Presentation

Accrual Accounting Concepts Chapter 3 Online Presentation

Month End Closing Checklist Month End Financial Statement Income Statement

Month End Closing Checklist Month End Financial Statement Income Statement

Accounting Practices 501 Chapter 8 Balance Day Adjustments Accrued Expenses Prepaid Expenses Cathy Saenger Senior Lecturer Eastern Institute Of Technology Ppt Download

Accounting Practices 501 Chapter 8 Balance Day Adjustments Accrued Expenses Prepaid Expenses Cathy Saenger Senior Lecturer Eastern Institute Of Technology Ppt Download

Prepaid Expenses Financial Edge

Prepaid Expenses Financial Edge

Prepaid Expenses Represent Payments Made For Expenses Which Are Not Yet Incurred In Other Words These Are Advanced Pa Accounting Basics Expensive Preparation

Prepaid Expenses Represent Payments Made For Expenses Which Are Not Yet Incurred In Other Words These Are Advanced Pa Accounting Basics Expensive Preparation

Difference Between Accrual Accounting And Finance Accounting Student

Difference Between Accrual Accounting And Finance Accounting Student

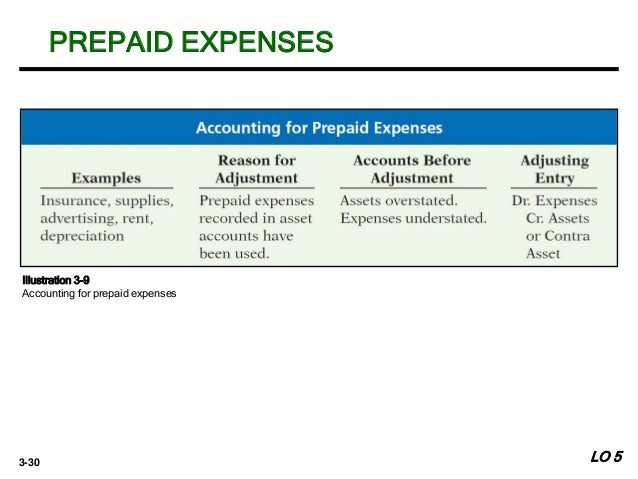

Accounting Principles 12th Ch3

Accounting Principles 12th Ch3

Post a Comment for "Prepaid Insurance Is An Expense Already Incurred But Not Paid"